Bank Statement Generator Form

What is the bank statement generator?

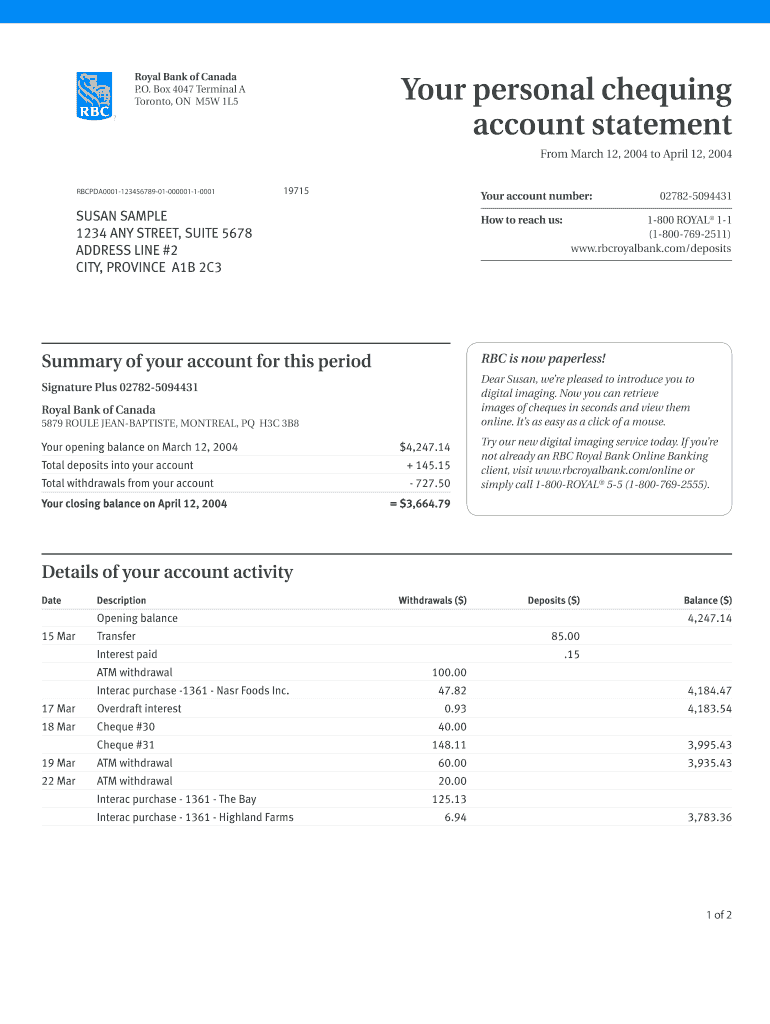

A bank statement generator is a digital tool designed to create official-looking bank statements for various purposes. This tool allows users to produce customized bank statements that reflect their financial activity over a specified period. It can be particularly useful for individuals and businesses needing to provide proof of income, verify financial status, or apply for loans. By utilizing a bank statement generator, users can efficiently create documents that meet specific requirements without the need to visit a bank in person.

How to use the bank statement generator

Using a bank statement generator is a straightforward process. First, select the type of bank statement you need, whether personal or business-related. Next, input the required details, such as account holder information, transaction history, and the time frame for the statement. After entering the necessary information, review the document for accuracy. Once confirmed, you can save or print the generated bank statement for your records or submission. This process streamlines the creation of bank statements, making it accessible for anyone needing documentation quickly.

Legal use of the bank statement generator

When utilizing a bank statement generator, it is essential to ensure that the generated documents comply with legal standards. A valid bank statement must contain accurate information and be generated using a reputable tool that adheres to eSignature laws and regulations. Compliance with frameworks such as the ESIGN Act and UETA is crucial for ensuring that the document holds legal weight. Additionally, incorporating security features, such as digital certificates and audit trails, can enhance the legitimacy of the bank statement, making it acceptable for various official purposes.

Steps to complete the bank statement generator

Completing a bank statement generator involves several key steps:

- Choose the appropriate bank statement template based on your needs.

- Enter the account holder's name and address accurately.

- Input the bank name and account number to ensure proper identification.

- List all relevant transactions, including dates, descriptions, and amounts.

- Select the desired date range for the statement, such as three months or six months.

- Review the completed statement for any errors or omissions.

- Save or print the document as needed.

Key elements of the bank statement generator

Several key elements contribute to the effectiveness of a bank statement generator:

- Customization: The ability to tailor the statement according to specific needs, including transaction details and timeframes.

- Security: Features like encryption and digital signatures that protect sensitive information.

- Compliance: Adherence to legal requirements to ensure the generated statements are recognized as valid.

- User-friendly interface: An intuitive design that simplifies the process of creating bank statements.

- Accessibility: The option to generate statements from any device with internet access.

Examples of using the bank statement generator

Bank statement generators can be utilized in various scenarios, including:

- Providing proof of income for rental applications.

- Submitting financial documentation for loan applications.

- Verifying account balances for tax purposes.

- Creating records for personal budgeting and financial planning.

- Generating statements for business activities, such as expense reporting.

Quick guide on how to complete personal bank account statement form

Prepare Bank Statement Generator effortlessly on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documentation, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Handle Bank Statement Generator on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The easiest way to alter and eSign Bank Statement Generator with ease

- Locate Bank Statement Generator and then click Get Form to proceed.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Bank Statement Generator to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I apply for a Schengen visa from India, and what are the financial requirements? I would like to know how much funds I need to show on my bank account for a 14-day trip to Europe.

First thing first “Finalizing the Visa Consulate”:If you are planning to tour more than two countries in the Schengen area then apply for visa to the embassy/consulate of the country you will be residing in for most of the travelling days, often referred as the main destination. If two countries have the same number of days then choose the one where you are planning to land or exit.In case you do not have a fixed itinerary (not recommended, though), and you plan to visit several countries in the Schengen area randomly, then apply to the embassy/consulate of the country which you are entering first.Since now you know which embassy you need to apply, next is how to apply and what are the documents required.Long trail of documentation:The most painful part is this, where you need to prepare the documentation. I will keep the checklist simple and provide rationale on why they ask for the particular document which will help you understand the significance of it and you can produce a substitute, if possible and required1) Valid passport (issued within the last 10 years and with at least 3 months validity after the scheduled return; passports with observations regarding the front data page are no accepted) with at least two empty pages Nothing much to say, of course you need a valid passport. Since the maximum stay with a Schengen visa can be of 90 days, so 3 months validity is required on the passport. Two blank pages, because one will have Visa sticker and the other page will have Indian immigration stamps and the stamps from the Schengen country where you are landing and exiting.2) 2 passport pictures according to biometric specifications, not older than 6 months Go to the studio and get a photo of the dimension 35 mm in length and 45 mm in height. Your face (the start of the hairline in the forehead till end of your chin) should be between 32 mm to 36 mm. Get the photo in a light background, white is preferred. Detailed information can be obtained here Cheap Tip: Do not go to any fancy studio and spend a bomb on just the photo. The consulate needs a clean and clear photo with the above mentioned specifications (which are very general) and not for featuring you as a playboy model, so save the buck.3) Leave letter of your company (if employed)This letter serves as a proof of return to your own country, so make sure the letter clearly states your designation, since when you are working with the company, leave dates (mandatorily covering your entire stay), date on which you will resume your duties.No-objection certificate of school or university (if student) This is pretty much same as the above.4) Proof of financial status If employed:Payslips of the past three months / employment contract Provide either of them, not both. Provide three latest Payslips, as it clearly states how much you are earning and if you are capable of surviving a European trip. This document helps the Visa officer gauge your financial status and also validates that the money earned is legal.If self-employed:Certificate of Proprietorship or other proof of ownership (proof of land title, proof of income from agriculture (sales form) etc.) 5) Income Tax Return (ITR) form or Form 16(Certificate of Income Tax deducted at the source of salary)It ensures that all the fund in your bank account is earned legally. Though my experience is that, they hardly care how you have earned the money. If they see there is enough fund available in your account then they are fine.6) Personal bank statement of the past three months with sufficient fundsHere they look into couple of things; first, money in your account is sufficient to cover your entire stay in Schengen area during your travel period. Second, the fund has not been deposited all of a sudden to inflate the available balance. I have written below in detail on how much you should show in your bank account, so keep reading. The bank account statement can be online, but make sure it is a bank statement with details of transaction and not just an account summary. You can show travelers cards (with statement stating available balance), credit card statement, and fixed deposits in your name or joint accounts. If anyone is sponsoring you (like your father or mother), a sponsoring letter addressed to the consulate from him/her and his/her bank statement for last 3 months.7) Proof of accommodation for your entire stay in the Schengen area.This is vital, I have read and heard personal experiences where the Visa has been cancelled due to discrepancy in accommodation arrangements. Make sure you have confirmed hotel bookings with details of the property owner/manager and property details (address). If you are staying at friends/relatives place then copy of their passport (with valid residence permit, in case of non-EU citizen) and an invitation mail will be sufficient as long as you are sponsoring your own stay.8) Flight and transport reservation Again, very vital. Many applications got rejected because of fake bookings. DO NOT make a fake reservation. Search for flights which has minimal cancellation charges and book your flights well ahead of travel date (45-60 days prior) to get a good deal. If you are travelling within Schengen countries then it is advised to show them train/bus bookings for inter-nation travel. One need not show travel details within the country, say if you are travelling within Italy (Rome to Florence) then need not show prior bookings. But if you are travelling from Italy to Switzerland then it is advised to show a confirmed booking.9) Travel Insurance Vital to get visa and also for your own sake. If something unwanted happens and you need to avail medical services then you will be ripped off everything as healthcare is expensive in whole of Europe. The travel insurance must cover Euro 30, 000.00 in case of hospitalization and must cover emergency medical evacuation and repatriation of remains. The list of approved travel insurance companies can be fetched here.10) Proof of civil status Marriage certificate, birth certificate of children, death certificate of spouse, ration card if applicable or Aadhaar Card.11) 1 copy of your passport’s data page Print the first two pages and last two pages of your passport in an A4 size paper.12) Residency proof, if address in the passport falls outside the jurisdiction region of the consulate: Which consulate or which region you can apply? You can apply at the region (North, South, East or West) where you are residing for last 6 months.This is something none of the blogs available in the internet have mentioned clearly. In case you are a domicile of different region and applying at a different region (domicile of Uttar Pradesh, North and working in Bangalore, South for last 3 years), or simply if the address mentioned in your passport does not fall under the jurisdiction region of then consulate then you need to provide either a copy of your rent agreement, or a letter from your company HR clearly mentioning your address or some utility bill (electricity, water or telephone bill).13) Duly filled application form Kept at last, because it is important. You can either fill an online application (recommended) or also can fill an offline application. German consulate online application can be filled here , similarly other Countries’ application form can be found in the respective VFS website. Self-Declaration Form can be found here, required only for German consulate. It is recommended to fill the online application form, it not only saves time at the application center but also legibility is better than the handwritten one.14) Cover Letter A letter addressed to the consulate you are applying. It must contain the followingPurpose of visit (tourism, visiting friends or family)Detailed itinerary If you have a sponsorExplain your personal relationship with your sponsor and the reason why they will be sponsoring your tripIf you cannot submit any of the required documents, write about the reasons why you cannot submit and explain alternative documents that you may have submittedYou can also mention the reasons why you will not overstay the visa period (employment, personal assets, etc.), explain your rootedness to the countryCool Tip: You can attach the itinerary separately which will enhance the readability of your letter.Write to me at universallocalite@gmail.com if you require a specimen cover letter or template of itinerary, I will be more than happy to help you with one.Visit my blog-How to obtain a Schengen Visa-Rules and tips

-

What is the most selfish act you have ever witnessed?

When I was twelve, my dad died. I have five siblings and we ranged at the time from seven years old to eighteen. The eldest was leaving for college that week, but came back and spent the year at home at my mom's request.Before Dad had been dead a whole month, my mom started sort-of dating a sort-of homeless guy (he had been homeless and then was living in an RV on someone's property as their caretaker) my family had helped before (we volunteered for years prior to this at the local homeless shelter).A month. Our father had died of unexpected of complications from heart attacks just a month prior. We four youngest didn't know what was going on at first and she didn't let our older two siblings know. All we knew was that almost every night mom would have us get in the van, and she'd be in her pajamas and robe, and we'd drive down to his place and she'd send us to go play in the yard while she "said goodnight" and "ministered" to him.Eventually she'd come out with a shit-eating smirk, load us up in the van and drive back home.Less than two months after that she moved him into the house and started claiming they were married to everyone. (They weren't.)Why this was so incredibly selfish was because we weren't allowed to grieve anymore after that. We all had to be happy because mom had a new boyfriend-then-husband, and we all felt like we couldn't even talk about Dad anymore. Mom still talked about him but only to force our good behavior, ie: "You are all such terrible children! Your father wanted you to be raised this way and I've sacrificed so much for you...!" He wasn't even a good stepdad. He could have been worse, sure, but he'd fight with mom then storm out of the house and she'd blame it on us.Less than six months after my dad died he and my mom went on a drive and left me to change a curtain rod. I was still twelve and very small for my age, and I couldn't signNow the curtain rod. I tried, hard, but I kept falling off the back of the couch. They got back and saw that I hadn't done it, so the step-dad kept saying to me "Hah, I knew you were useless." while laughing and repeating it over and over like it was hilarious. I lost my temper and said "You're just a fat old man!" (he was 13 years older than my mom so he seemed quite elderly to me.) He, in front of my mother who had been laughing at his denigration of my handyman attempts, grabbed me, shook me hard, and screamed in my face "You stupid little b***ch!" and stormed out of the house.Mom then spanked me for trying to ruin her marriage.I just wanted my dad back, but I couldn't even say that because what if it made the step-dad feel bad?

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can I deactivate Axis bank Customer Care Number., / account permanently?912332–6395

This answer comes down from my personal experience. I have been an overwhelmed Axis bank customer for the past 5 years or so. Always loved their customer-focused services.In the better part of last year, there were a number of incidents that led me to search for steps on how to close Axis bank account.I’m penning down the steps I followed to close my axis bank account.Visit your nearest Axis bank branch ( Home Branch works better)Ask for the account closure form, fill it end to end.Submit the passbook, cheque book and the debit card to the bank employee. Be sure to keep a copy of most recent bank account statement for future reference.Your account should have some credit left before the account closure process. This money will be transferred to the other account, the details of which you’ll mention in the account closure form.Provide ID proof during this process to authenticate your identity.There are account closure charges that will be levied by the bank. These vary by the account category. Check out this link for Fee & charges for your axis bank account category.Post this your Axis bank account will be closed in 2 days and the leftover money will be transferred to your other account within 7 working days(standard policy).I hope this helps.

-

How can I learn mutual funds investment?

Its not that complex… Here, i have written everything you need to know about Mutual funds. Read this, you can start investing without anyone’s help.Mutual fund is like fixed deposit where we deposit our money and it will give us return.There are three types of mutual funds, they are debt fund, equity fund & balanced fund.Debt fund is similar to Bank. When we invest our money in debt fund, fund house will use our money to give loans to private companies or Indian government or State government.Debt fund - Risk is low. Return is around 8%. If you withdraw money within 3 years, you need to pay tax based on your income tax slab (like 10% or 20% or 30%). If you withdraw after 3 years, you need to pay 20% tax with indexation.Indexation: 20% tax with indexation means you will be discounting inflation while paying tax. So you will be paying less tax after discounting inflation (less than 15%)Inflation: Inflation is most important factor when comes to finance. It means decrease in purchasing power of money. To give you an example, before 10 years Rs.10 is a big amount. But now??? In 10 years from now Rs.10 will be nothing. Thats the inflation, every year value of money will get reduced. Government regularly release inflation details.There are many types of debt funds like gilt, income, short term, liquid, ultra short term.Gilt fund - your money will be loaned to government. Risk is very low since borrower is Government.Income fund - you will receive monthly income. Suitable for retired people.Liquid fund - you can withdraw your money anytime without any charges. It is like savings account.Short term or Ultra short term - if you like to invest only for some months.Let me warn you, debt funds are not risk free. They too carry some risk. Sometimes company default loans (Vijay Mallya, Nirav Modi). Then there is a risk of interest rate.If like to invest with minimal risk, then open the debt fund in valueresearchonline website. There you will find the below diagram (or chart?). Good low risk debt fund should have black box in red area. The meaning is, the fund is less sensitive to interest rate change and has good credit quality.Equity fund. As the name says, your money will get invested in Share market.Equity fund is riskier than debt fund. But it gives good return like 12% to 25%. If you withdraw withing an year you need to pay short term capital gain tax of 15%. If you withdraw after 1 year and if your return is more than 1 lakh, you need to pay capital gain tax of 10%.It is recommended to hold equity mutual funds at least 5 years to see decent return.Equity mutual funds comes in many types like large cap, mid cap, small cap, sector.Large cap or Bluechip fund - your money will get invested in big companies. Risk is low and return is around 10% - 13%.Mid cap fund - your money will get invested in medium size companies. Return is more than 13%. Medium risk.Small cap fund - your money will get invested in small companies. Very risky but good return, more than 20%.Sector fund - your money will get invested in companies in specific sector. For example, Equity Infra fund means, your money will get invested in Infrastructure companies. Return varies based on sector, but it will be more than 15%.Index fund - Return is around 10%. Medium risk.What is index fund? There are many indices in India like Nifty, Sensex, Bank nifty, etc., Each index comprise of many companies with different weightage. For example, Nifty comprise of top 50 companies in NSE. If you invest your money in Nifty index fund, it is like investing in top 50 companies in NSE.ELSS - It is tax saving mutual fund. You can save tax under Section 80C. It is getting popular now. Lock in period is 3 years. Return is around 12%.Arbitrage fund - It is very very low risk equity fund. Arbitrage fund won’t get affected by markets up and down. Return is 8%. Taxing is same as equity mutual funds.Balanced or Hybrid fund. It is mix of Equity and Debt fund. (65% equity and 35% debt). Low risk. Return around 12%. Taxation is similar to equity fund.First, choose fund type based on your risk potential (like debt or equity or balanced).If you are retired person or if you don’t want to take any risks then choose Debt funds.If you like to take only small amount of risk, choose balanced fund.If you earn average income, then choose balanced fund or large cap or both.If you fall under huge income category, then mix large cap, mid cap and small cap.To choose fund, visit Funds - Value Research Online. Here are the list of things to note while choosing fund…See the fund’s performance from inception. See yearly, 3 year, 5 year and overall return.See the expense ratio. Expense ratio is the amount you are going to pay as commission. Less than 1% is better.See exit load. This is amount you need to pay when you withdraw.Value research online gives star rating for all funds. Choose funds with atleast 4 Stars.IMPORTANT NOTE: All funds comes in two plans Regular & Direct plan. Regular means you invest via Broker or Agent. Direct means you invest directly. Broker or Agents charge commission. Their commission will be around 1% per year. IT IS LOT OF MONEY. So never go with Broker or Agents.If you are new to mutual fund, you need to register KYC first. It is one time process and it is centralized. Once you get registered, you can invest in any mutual funds just by giving your PAN number. To register KYC, first select fund house (example, SBI Mutual fund or HDFC mutual fund). Find their office in your city and go and register KYC. You can also register e-KYC online, but it has some limitations. So i suggest you to visit office and do it in person.Once KYC is done, you can invest in any mutual funds. If you do KYC in SBI mutual fund, you can also invest in HDFC or ICICI mutual funds. KYC is centralized.Once KYC is done, visit mutual fund company website (like SBI mutual fund site or LT mutual fund site). Register there. Start investing. You can either invest as Lump sum. Or as SIP. SIP means you can invest small amount monthly. Money will be automatically deducted from your account.FAQ:When should i invest?If you are planning to invest via SIP you can start anytime. But if you are planning to invest as Lumpsum, there is a completely different approach. If you like to invest lumpsum in debt fund. You can invest anytime, no issues.But if you like to invest lumpsum in equity mutual fund, you need to follow different approach, since investing lumpsum in equity mutual fund is very risky. First invest your lump amount in liquid fund or ultra short term debt fund [Lets call Fund A]. These funds don’t have exit load (or withdrawing fee), so there is no charges when money gets transferred. Now, set up STP (Systematic Transfer Plan) to transfer a fixed amount monthly to an equity fund [Fund B]. For example, if you have 1 lakh lump amount, set a monthly amount to Rs.5,000. Every month, Rs.5,000 from Fund A will get transferred to Fund B. Fully automatic.Note: Never invest lump amount directly in equity mutual funds.Is there any service which helps me to invest in Mutual funds easily?There are so many apps these days which help you to invest money in mutual funds via direct plan. Like, Zerodha Coins [Not a promotion, you can try any app you want]. These apps are not free, they charge small amount monthly. You can easily set up investments from the app and also you can track the fund performance. I personally find such apps useful.I heard mutual fund is risky.Every investment is risky, whether it is real estate, gold or FD.Gold. What if someone stole or you lose is somewhere? Think how many times you heard from your friends or relatives (or happened to you) that they lost Jewels?FD. FD return is very low. If you are a tax payer and if you invest in FD, then you are LOSING MONEY because of tax and inflation. You will be losing 1% or more per year if you invest in FD. And also, what happens if bank goes bankrupt? FD is insured for Rs.1 lakh. If you have 10 lakhs in FD and bank goes bankrupt, you receive Rs.1 lakh.Real estate. Many factors affect real estate like current government, policies, economy, water issue, etc., And there is liquidity problem . You can’t buy or sell real estate fast.Like these mutual funds also carry risk. If you plan properly you can reduce the risk by investing GILT fund or Arbitrage fund. Remember, mutual fund house invest your money in companies like ICICI bank, TCS, ITC, Tata motors, etc., It is very unlikely that these companies shut down their business.Is it true that debt fund carry Zero Risk?No. As i said earlier Risk is everywhere. When compared with equity, debt fund carry low risk. Still there is some risk. Companies default their loan (remember Kingfisher?). Companies goes bankrupt.What funds are you investing?I am investing in…Aditya Birla SL Balanced '95 Direct-G (Balanced fund)IDFC Focused Equity Direct-G (Large and mid cap)L&T Emerging Businesses Direct-G (Small cap)What should i choose? Growth or Dividend or Dividend reinvestment?Growth - To unleash the power of compound interest choose Growth. It will give you massive return in long term. (Recommended)Dividend - If you want regular income from your investment, then choose Dividend. This option is recommended for retired people.Dividend reinvestment - Companies release dividend regularly. If you choose this option then fund house will buy new units of the fund with dividend money.If I choose dividend fund, do I need to pay income tax for dividend income?No, there is no income tax for dividend income.What is the minimum age required to invest in mutual fund?There is no minimum age. You can start at any age. If you are below 18, you need to provide birth certificate.What is the minimum amount needed to invest in mutual fund?You can start with as low as Rs.500.I am already investing via Regular plan. How to switch to direct plan?Visit fund company website. Register yourself and login. There will be option to Switch. While switching select Direct plan. Simple.How do I know whether I am investing in Regular plan or Direct plan?Login to your account or check your statement. See the fund name. If the name ends with Direct, it is direct plan. Or if it ends with regular it is regular plan.What should i do after investing?It takes atleast 5 years to see decent return from equity mutual funds. Bookmark the website value research online. It is popular site about mutual funds. They give star rating for all mutual funds. Good fund should have atleast 4 stars. Every once in a while check number of stars for your fund. If it goes below 3 stars, i suggest you to switch fund.I am investing in equity mutual fund. I got negative returns. Now i have less money than what i invest. What should i do?Market fluctuates. It is normal. As i said earlier, you need to wait atleast 5 years to see decent return from equity mutual funds.How to withdraw money?Login to your account. Choose redeem option. Money will be withdrawn to your bank account.How to terminate mutual fund?First redeem your money. Then you need to send post (physical, no email) to mutual fund company asking them to terminate. But it is not necessary. Just withdraw money and done with that.What happens if I fail to pay monthly instalment for SIP because of no funds in my savings account?Nothing will happen. Don't worry.How to switch funds?Case 1: Switch funds from same fund house. For example, LT Fund A to LT Fund B. Login to fund house website. Choose switch option. It is simple.Case 2: Switch funds of different fund house. For example, LT Fund A to SBI Fund A. There is no direct option for this. First you need to withdraw money from fund A and invest freshly in Fund B.How to track my mutual funds investments?If you are investing via apps like Zerodha coin, you can easily track form those apps.What are open ended and close ended mutual funds?When comes to mutual funds always go with open ended funds. Open ended fund gives better return than close ended. And also you can enter and exit open ended funds anytime.———————————————————————————————————Hope, i explained everything here. Please don’t contact me with questions which i already explained here. I won’t respond. Spend some time to read. If i missed anything, do comment here.Invest with your own risk. Market fluctuates, sometimes market crashes, companies default their loans. Anything can happen. I am just sharing knowledge.Happy investing.Ashok Ramesh.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I get a visitor's visa of the UK from India?

My family and I had applied for a standard UK Visitor’s Tourist Visa (Short Term - 6 months) and received it within 10 days of submission in March 2017 in Mumbai. I was travelling to Europe with my wife and in-laws. Embassy norms dictate that one must obtain UK Visa prior to Schengen Visa irrespective of which country you enter first, if UK happens to be on your travel itinerary. My wife and I have travelled abroad several times however this was the first foreign trip for my in-laws. My father in-law and I also had sufficient funds (above Rs. 2 lakhs) maintained regularly in our 6 month bank account statements and sufficient income (above Rs. 5 lakhs per annum).The procedure is very straightforward and robotic. Unfortunately, there is no Indian Telephone Helpline to guide people who have doubts regarding the same. Also the UK Visa authorities were unhelpful when I asked them doubts over email too. Here is my experience so that others too can obtain their Visa easily.Create an account on Welcome to Visa4UK. You can fill multiple application forms for different people using the same account. I created an account and filled out the forms for all 4 of us.The application form is quite lengthy and at times irrelevant. It is about 10 A4 pages long. The Visa Authorities merely wish to confirm if you are a genuine applicant with no criminal record and with sufficient finances to support your stay. They will also ask extra details of your properties and investments. As we had sufficient funds in bank and a steady income proof over the last 3 years, we left these extra details blank. You can refer this Guide for more information - https://www.gov.uk/government/up...After filling the forms, you have make the payment of Rs. 7830 per application and take an appointment. We picked the earliest possible appointment, which was about 1 week later. Print all the necessary forms including your Application Form, Appointment Letter, Receipt, Passport Xerox, Travel Tickets, Hotel Reservations, Income Tax Returns, Bank Account Statements, Marriage Certificate (in case your spouse’s name is not mentioned in your passport), Travel Insurance, Cover Letter (explaining why are you applying for Visa) and anything else pertaining to your trip. It is better to give them extra information rather than have your application rejected over lack of sufficient information.signNow the Visa Application Centre on time otherwise there is an extra charge of Rs. 2560 for those who signNow late. I had seen a couple harrowed for the same as they had applied through an Agent who had not informed them the appointment timing correctly. Carry your original documents such as Passport, Bank Passbook, Marriage Certificate, etc. as they are required for submission. No one at the Submission Centre will assist you with extra information as there are extra charges for the same. We opted for the SMS facility at Rs. 140 per person.The documents of a couple will be bunched together for submission. The biometric data will be taken and you will be asked to leave immediately after all this. There is a Britain Travel Shop at the exit, which might tempt you for booking SIM Cards, Travel Cards and Attraction Tickets at a discount, but I found their prices to be higher than those available online at Viator and other websites.We received a mail and SMS after 9 days that our processed application was dispatched from Delhi. We picked up a sealed package with our name from the Application Centre on Day 10. We were not allowed to open it at the Centre and were asked to leave immediately. Fortunately, when we opened the package, we had obtained the Visa on our Passport and all our original documents were bundled in 1 package.Overall, it was a pretty simple procedure, but without anyone’s assistance it could get tricky to complete it by yourself. However, if you have all travel documents and finances in place, then you can confidently apply for the Visa without worry of rejection.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

Create this form in 5 minutes!

How to create an eSignature for the personal bank account statement form

How to create an eSignature for your Personal Bank Account Statement Form in the online mode

How to make an eSignature for the Personal Bank Account Statement Form in Chrome

How to generate an electronic signature for signing the Personal Bank Account Statement Form in Gmail

How to create an eSignature for the Personal Bank Account Statement Form straight from your smart phone

How to create an electronic signature for the Personal Bank Account Statement Form on iOS devices

How to create an electronic signature for the Personal Bank Account Statement Form on Android OS

People also ask

-

What features does airSlate SignNow offer to help make bank statements?

airSlate SignNow provides features like customizable templates, eSignature capabilities, and secure document storage to help you make bank statements efficiently. With these tools, you can simplify the process of creating and sending digital bank statements, ensuring a quick turnaround.

-

How can airSlate SignNow improve my workflow for making bank statements?

By using airSlate SignNow, you can streamline your workflow to make bank statements through automated processes. Our solution reduces manual entry and provides reminders, making it easier for you to manage document signing and delivery consistently.

-

Is there a cost associated with using airSlate SignNow to make bank statements?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, starting at a competitive rate. This cost-effective solution allows you to make bank statements without incurring hefty expenses usually associated with traditional methods.

-

Can I integrate airSlate SignNow with other software to make bank statements?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, enabling you to make bank statements directly from your existing tools. This integration enhances efficiency by allowing you to access and manage your documents across platforms.

-

What security measures does airSlate SignNow have for making bank statements?

Security is a top priority for airSlate SignNow. When you make bank statements, you can rest assured knowing that your data is protected through encryption and compliance with industry standards, ensuring that your sensitive financial information remains confidential.

-

How user-friendly is airSlate SignNow when making bank statements?

airSlate SignNow is designed with user-friendliness in mind, making it simple to make bank statements even for those with limited tech skills. The intuitive interface guides users through the process, helping them create and manage documents effortlessly.

-

Can I customize my templates in airSlate SignNow to make bank statements?

Yes! airSlate SignNow allows you to customize templates to make bank statements that fit your business branding and requirements. This flexibility ensures your documents are professional and meet specific standards.

Get more for Bank Statement Generator

- Lesson 11 1 comparing data displayed in dot plots answer key form

- Macc gift shop consignment bapplicationb city of marquette mqtcty form

- Visionworks com contactlensrebates form

- Delaware residential lease agreement form

- 1040es me form

- Informal observation examples

- Tb 43 180 pdf form

- Form 1099 b proceeds from broker and barter exchange transactions

Find out other Bank Statement Generator

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking